What to Do if You Can’t Find Your Policy?

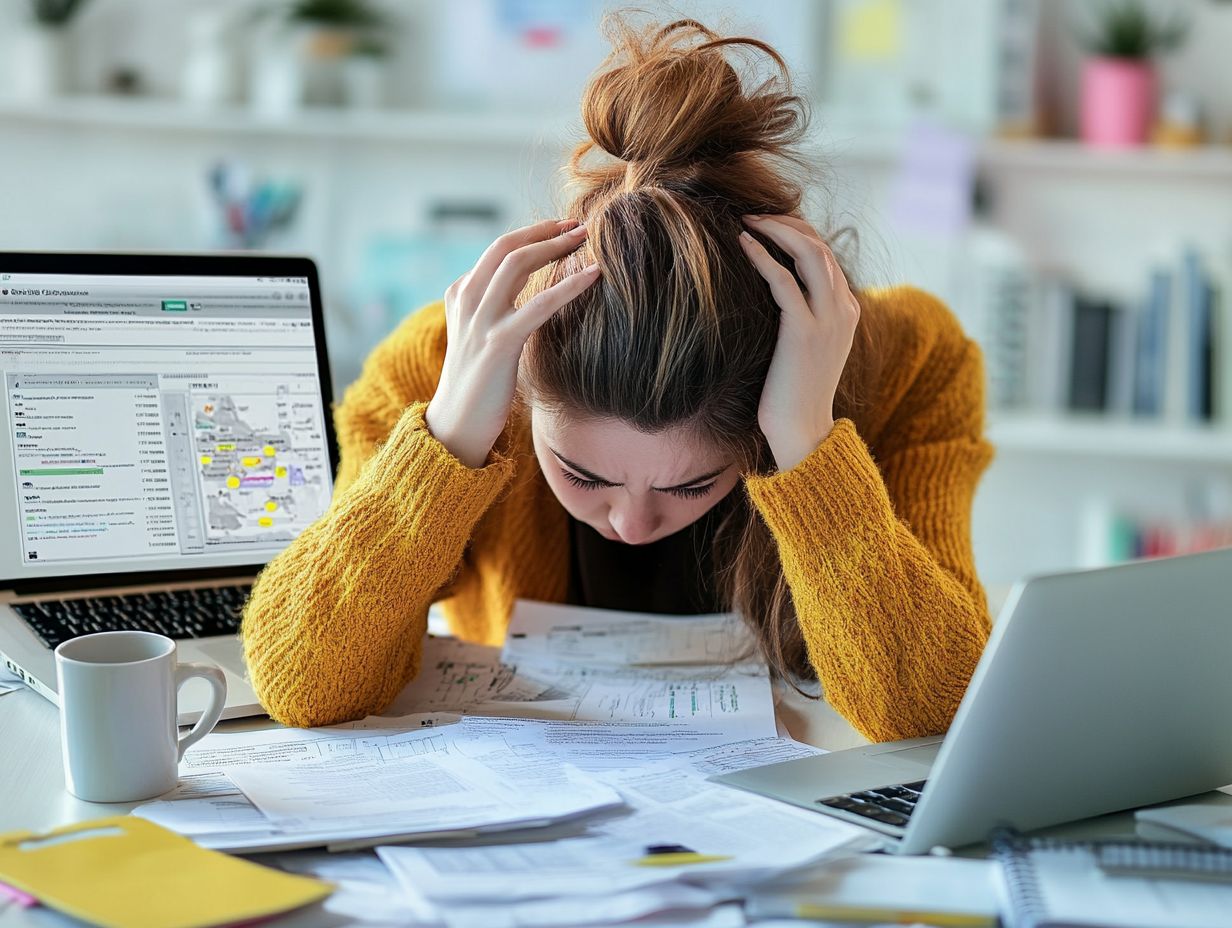

In today s fast-paced world, keeping tabs on essential documents like your insurance policy can feel like an uphill battle. Whether it s buried under a mountain of papers or lost in the digital abyss, not knowing where your policy is can create unnecessary stress.

Don t let the stress of losing your policy weigh you down take action today and regain control of your essential documents! This guide will help you understand the importance of having your policy at hand, outline the steps to take if it goes missing, and provide practical tips for staying organized moving forward.

Contents

- Key Takeaways:

- The Importance of Having a Policy

- Steps to Take if You Can’t Find Your Policy

- What to Do If You Still Can’t Find Your Policy

- Tips for Keeping Track of Your Policy in the Future

- Frequently Asked Questions

- Can’t Find Your Policy? Here’s What to Do!

- What if I Don’t Remember Which Insurance Company Provides My Policy?

- Can I Request a Copy of My Policy from My Insurance Provider?

- What Information Do I Need to Provide When Contacting My Insurance Provider About My Lost Policy?

- Is There a Fee to Get a Copy of My Policy?

- What If I Have Multiple Insurance Policies and Am Not Sure Which One I Am Missing?

Key Takeaways:

Having a policy is your safety net for protection and clarity! If you can’t find your policy, first check your records and then contact your insurance provider. If all else fails, consider replacing your policy or seeking legal assistance.

The Importance of Having a Policy

Having a life insurance policy is essential for securing financial stability and peace of mind for your family in the event of your passing. It acts as a safety net, providing the necessary funds to cover expenses like funeral costs, outstanding debts, and ongoing living expenses for your loved ones.

Numerous insurance companies offer a range of life insurance options tailored to different needs. This allows you to select a plan that suits your family s financial landscape. Consulting a financial advisor can clarify your options and help you determine the right coverage to safeguard your family’s future.

Understanding the Purpose of a Policy

A life insurance policy is designed to provide a death benefit for your beneficiaries upon your passing, ensuring they remain financially secure when you re no longer there to support them.

Some policies can also serve as investment tools. For example, permanent life insurance like whole or universal life combines a death benefit with a cash value component that grows over time. This allows you to access funds while you re still living, providing flexibility for your financial needs.

On the other hand, term life insurance offers coverage for a specific period. This makes it an ideal choice for those seeking an affordable way to protect their loved ones during crucial financial milestones, such as raising children or paying off a mortgage.

It s important to remember that when it comes time to file a claim, having the right documentation is essential. This includes any necessary information from the Medical Information Bureau, a service that helps insurance companies check medical histories, to ensure a seamless process and precise disbursement of benefits.

Steps to Take if You Can’t Find Your Policy

Losing sight of your life insurance policy can be quite distressing, particularly when you’re trying to access the death benefit for a loved one who has passed. Fortunately, there are several effective steps you can take to locate your policy with ease.

- Start by meticulously reviewing your financial documents, including bank statements and any safe deposit boxes where you may have tucked away insurance paperwork.

- If you still can t find it, contact your financial advisor or the insurance companies directly they can help!

Check Your Records

When searching for a lost life insurance policy, your first step is to meticulously examine all your financial records and documents. This includes scrutinizing your tax returns, which may reveal deductions or reports related to life insurance. Also, check any past insurance documentation that might offer clues about active policies.

It s wise to gather any correspondence with insurance companies that you may have overlooked. This includes letters regarding policy updates or claims.

To uncover unclaimed property, leverage state resources like unclaimed property databases. These can help identify any potential benefits tied to those lost policies.

Don t wait until it’s too late take these steps now to secure your financial future!

Contact Your Insurance Provider

Reaching out to your insurance provider is a crucial step in uncovering a missing life insurance policy. It also helps clarify beneficiary information. To ensure a seamless interaction, be prepared with essential personal details.

When you contact the insurance company, having the following information readily available can be immensely helpful:

- Social Security numbers

- Dates of birth

- Relevant policy numbers

Know the names of policyholders and beneficiaries. This can speed up the search process. Being organized with this information aids the agents in assisting you more effectively and ensures that no important details are missed.

This careful preparation leads to a clearer understanding of your policy status and any available benefits.

Search Online Databases

Using online databases can significantly elevate your quest for a life insurance policy. This is particularly true when navigating the complexities of unclaimed property.

By tapping into resources like the National Association of Insurance Commissioners (NAIC) service, you can track down those elusive missing policies. These online tools offer invaluable insights on how to connect with insurance companies and access their records.

It’s crucial to ensure that the information you provide during your search names, dates of birth, and policy numbers is accurate. This level of accuracy streamlines your search and boosts your chances of locating a policy quickly.

What to Do If You Still Can’t Find Your Policy

Still can’t find your life insurance policy? Act now to secure your family’s financial future!

Consider Replacing Your Policy

If you find yourself unable to locate your original life insurance policy, consider getting a replacement from reputable insurance companies. This could provide you with a fresh start, featuring improved terms and coverage options tailored to your current needs.

Exploring new life insurance policies may reveal advantages such as permanent coverage that lasts a lifetime. This ensures peace of mind for both you and your family.

When evaluating different plans, assess factors like the financial strength of the insurer and the variety of benefits offered. Ensure each policy aligns with your family’s financial needs and long-term aspirations.

A meticulous comparison will guide you in selecting a plan that offers complete protection and cultivates a sense of security for your loved ones. Start comparing policies today to find the best fit for you and your family!

Seek Legal Assistance

Engaging a financial advisor or seeking legal assistance may become essential when you can’t locate your life insurance policy. This is especially true in the context of estate planning.

Estate planning means planning how your assets will be managed after you pass away. These professionals are pivotal in managing the complexities, ensuring that assets are allocated in accordance with the deceased s wishes.

They expertly guide you through the intricate web of beneficiary designations, clarifying who is entitled to receive specific benefits. Their expertise is invaluable for filing claims, as they deftly navigate the often cumbersome and confusing documentation processes.

By collaborating with a financial advisor or attorney, you can achieve peace of mind. You ll be confident that all necessary steps are in place to protect your loved ones and effectively fulfill final wishes.

Tips for Keeping Track of Your Policy in the Future

Monitoring your life insurance policy is crucial to guarantee that your loved ones remain protected.

By implementing several proactive strategies, you can effectively prevent any potential complications down the road.

Organize Your Important Documents

To manage your life insurance policy effectively, it s essential to organize your important documents with precision.

Start by creating a dedicated folder specifically for your insurance documentation, ensuring that all relevant papers are conveniently located in one easily accessible place. For added security, consider storing these documents in a safe deposit box, keeping them safe from loss or damage.

Make it a habit to check your bank statements to confirm that you are paying your life insurance fees on time. This will help you stay on top of your financial commitments.

By taking these steps, you can enjoy peace of mind knowing your policy remains active and up-to-date.

Regularly Review and Update Your Policy

Regularly reviewing your life insurance policy is vital! It ensures you have the right coverage and that your beneficiary information is always current.

This practice helps you see your changing needs, especially as life events unfold think marriage, the arrival of a child, or other significant milestones.

Such moments often lead to shifts in your financial responsibilities and priorities, making it imperative to adjust your coverage accordingly.

Periodic reviews allow you to examine changes in premium payments, which can fluctuate due to various factors, including market dynamics or policy adjustments.

By staying proactive, you can avoid gaps in coverage and ensure that your policies are aligned with your personal circumstances and financial goals, ultimately providing you with peace of mind for the future.

Frequently Asked Questions

Can’t Find Your Policy? Here’s What to Do!

If you are unable to locate your policy, the first step is to contact your insurance provider directly. They can assist you in retrieving a copy of your policy or providing you with the necessary information.

What if I Don’t Remember Which Insurance Company Provides My Policy?

If you can t remember which insurance company provides your policy, you can check your bank or credit card statements for recent payments. You can also review any correspondence or emails from your insurance provider.

Can I Request a Copy of My Policy from My Insurance Provider?

Yes, you can request a copy of your policy from your insurance provider. Most insurance companies have an online platform where you can access your policy documents at any time. If not, you can contact your provider, and they can email or mail a copy to you.

What Information Do I Need to Provide When Contacting My Insurance Provider About My Lost Policy?

You will need to provide your full name, policy number (if available), and any relevant details about the policy. It may also help to have your insurance card or any previous correspondence from your provider ready.

Is There a Fee to Get a Copy of My Policy?

Some insurance providers may charge a fee for a copy of your policy, while others may provide it for free. It is best to check with your insurance company directly to see if there are any fees associated with obtaining a copy of your policy.

What If I Have Multiple Insurance Policies and Am Not Sure Which One I Am Missing?

If you’re unsure about any of your insurance policies, act quickly! Contact each provider to get clarity. You can also review your bank or credit card statements to see which insurance companies you have made payments to.