The Importance of Home Inventory for Insurance

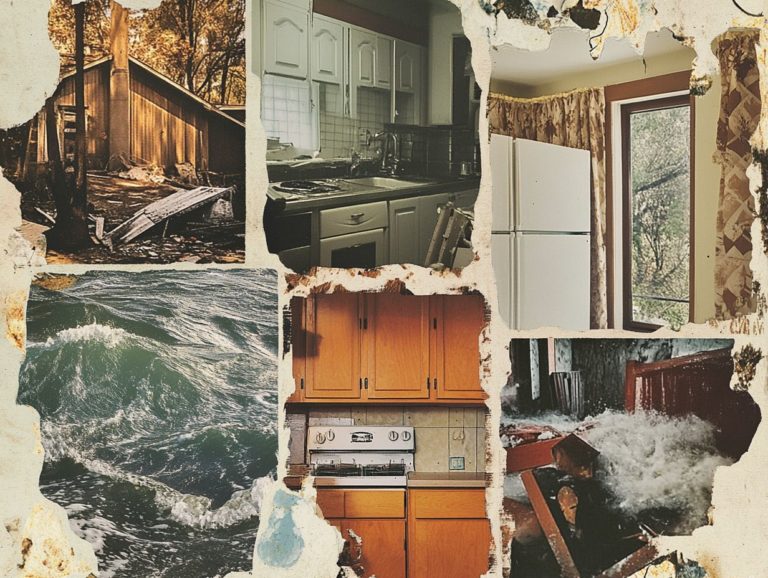

A comprehensive home inventory is an essential asset for homeowners, acting as a safeguard for your belongings and facilitating smoother insurance claims in the event of a disaster.

This article will clarify what a home inventory entails and explain its significance for your insurance coverage. You ll be guided through the process of creating an effective inventory, with practical tips on utilizing it during claims and the necessity of regular updates.

You will also discover how keeping this inventory boosts your emergency preparedness and supports estate planning. Dive in to secure your peace of mind!

Contents

- Key Takeaways:

- Understanding Home Inventory

- Creating a Home Inventory

- How to Use Home Inventory for Insurance Claims

- Maintaining and Updating Home Inventory

- Other Uses for Home Inventory

- Frequently Asked Questions

- What is the importance of having a home inventory for insurance coverage?

- How can a home inventory help me when filing an insurance claim?

- What should be included in a home inventory?

- How often should I update my home inventory?

- Do I need a physical or digital home inventory?

- Is it necessary to have a home inventory if I have insurance?

Key Takeaways:

Home inventory is a detailed list of all your belongings, providing proof of ownership and value in case of damage or loss. It is crucial for insurance as it helps determine the appropriate coverage and speeds up the claims process.

Creating and regularly updating your home inventory can save time, money, and stress in the event of an insurance claim.

Understanding Home Inventory

Understanding home inventory is essential for you as a homeowner. It involves creating a detailed list of your household possessions, including valuable items like collectibles, antiques, and furniture.

A solid inventory can change the game for your insurance coverage! It can play a vital role in preventing financial losses in the unfortunate event of disasters like fire or theft.

By maintaining a comprehensive home inventory, you can streamline the claims process with your insurance professional. Knowing what to include in a home insurance inventory ensures you receive the financial support needed to replace your belongings and comply with your insurance policies effectively.

What is Home Inventory?

Home inventory is your gateway to a detailed list of personal belongings within your residence. Whether you opt for an inventory checklist, smartphone apps, or digital backups, this process ensures that your valuable items are documented with care.

This comprehensive approach not only captures descriptions, quantities, and values but also incorporates enriching methods like photographs, videos, and detailed notes. By leveraging technology, you can effortlessly scan barcodes or snap pictures of your possessions, instantly linking these images to their respective entries.

Utilizing cloud-based storage solutions offers a secure way to maintain this vital information, allowing you to make quick updates following any new acquisitions or disposals. With the assistance of user-friendly mobile applications, managing an accurate and accessible home inventory has never been easier.

Ultimately, this gives you the power of peace of mind and efficient oversight of your personal assets.

Why is it Important for Insurance?

Having a detailed home inventory is crucial for you as a homeowner because it directly influences your insurance coverage. It streamlines the claims process when you need to file a claim and highlights the importance of a detailed home inventory, providing the essential documentation that insurance professionals look for.

By listing your personal belongings, you not only become more aware of what you own but also boost your ability to recover financially after a loss. This organized record simplifies the claims process, allowing for quicker resolutions and minimizing potential disputes with insurers over item valuations.

A well-maintained inventory connected to your coverage reduces stress during claims. When you have accurate documentation at your fingertips, the likelihood of receiving fair compensation increases substantially.

This offers you the peace of mind to know that you can confidently rely on your preparations should the unexpected happen.

Creating a Home Inventory

Creating a home inventory necessitates a methodical approach that allows you to organize your possessions effectively.

You’ll want to capture detailed descriptions of each item, estimate their value, and include photographic evidence using your smartphone camera. This process ensures that every household possession is meticulously accounted for, along with its corresponding worth.

Start your home inventory today to protect your belongings and ensure peace of mind!

Step-by-Step Guide

To create a thorough home inventory, start by selecting a reliable home inventory app designed to catalog your belongings. Gather video proof of your items, store receipts in a dedicated folder, and keep appraisal documentation for any high-value possessions.

By choosing an app specifically for this task, you streamline the cataloging process and ensure your items are easily accessible and organized. Once you ve settled on the app, conduct a detailed inventory by documenting each item, including brand, model, and condition.

Incorporating video offers a vivid snapshot of your belongings, making it easier to recall specifics later. Enhance each video entry with corresponding receipts, neatly filed for added context.

Regularly update your inventory to account for new purchases or disposals. This guarantees that a comprehensive record is always at your fingertips. Don t wait until it’s too late!

How to Use Home Inventory for Insurance Claims

Using a home inventory for insurance claims significantly streamlines the filing process. It provides insurance agents with accurate loss documentation, highlighting the importance of timely home insurance claims, allowing homeowners to efficiently secure financial assistance within their policy limits.

Tips for Filing Claims

When filing insurance claims, have copies of your insurance policy readily available. Document your belongings with detailed descriptions, and follow an efficient claims process to expedite disaster assistance.

Creating a comprehensive inventory of your possessions, including photographs as visual evidence, is a smart move. This ensures nothing slips through the cracks during the claims process and facilitates quicker assessments by insurance adjusters.

Understand your policy coverage and limitations to avoid unwelcome surprises later. Review the terms carefully. During a crisis, organized records including receipts and warranties offer reassurance and clarity, leading to a smoother experience when seeking the compensation you deserve.

Maintaining and Updating Home Inventory

Maintaining and updating your home inventory is crucial for accurately reflecting all your possessions. Regularly review items and declutter as needed, as this can significantly influence your insurance coverage and the efficiency of any claims you might need to make.

By staying on top of your inventory, you ensure you re fully prepared for whatever life may throw your way.

Regular Review and Updates

Set a reminder to review your inventory every six months. This routine allows you to track items that have been added or removed, maintaining accuracy and aiding insurance documentation.

Utilizing cloud storage simplifies the process, allowing immediate updates from anywhere. By categorizing your items and attaching photographs or receipts, your inventory becomes a comprehensive reference tool that’s easy to manage.

This proactive approach grants you peace of mind and ensures swift access during emergencies or claims, showcasing the undeniable advantages of embracing modern technology in home management.

Other Uses for Home Inventory

Beyond insurance considerations, maintaining a home inventory serves many purposes. It enhances your emergency preparedness and aids in estate planning, helping you minimize financial losses.

A detailed inventory can also potentially open the door to tax breaks for valuable items you’ve documented, adding another layer of benefit to this essential practice.

Emergency Preparedness and Estate Planning

Incorporar un inventario del hogar en su preparaci n para emergencias y planificaci n patrimonial es esencial para asegurar que todos sus art culos valiosos y propiedad personal est n contabilizados. Esta pr ctica simplifica la gesti n de sus cosas cuando surjan problemas inesperados.

Este enfoque integral no solo agiliza la recuperaci n despu s de desastres, sino que tambi n proporciona claridad al evaluar el valor de sus pertenencias durante las transiciones de bienes. Un cat logo detallado de sus posesiones puede ser invaluable para verificar reclamaciones de seguros, especialmente durante esos momentos estresantes.

Esta documentaci n ayuda a prevenir disputas entre herederos, asegurando que todos est n al tanto sobre la distribuci n de los activos. Al actualizar regularmente su inventario, se asegura de que los art culos adquiridos recientemente y cualquier cambio en el valor se capturen con precisi n.

Esto tambi n mejora su tranquilidad y fortalece la seguridad financiera para usted y su familia.

Frequently Asked Questions

Here are some common questions about the importance of having a home inventory:

What is the importance of having a home inventory for insurance coverage?

Tener un inventario del hogar es crucial para la cobertura del seguro, ya que ayuda a evaluar con precisi n el valor de sus pertenencias en caso de robo, da o o p rdida.

How can a home inventory help me when filing an insurance claim?

Un inventario del hogar puede servir como evidencia de los art culos que pose a y su valor, facilitando que su compa a de seguros procese y apruebe su reclamaci n.

What should be included in a home inventory?

Un inventario del hogar debe incluir una lista detallada de todas sus posesiones, con descripciones, fotos y recibos. Tambi n debe incluir art culos valiosos o de alto costo.

How often should I update my home inventory?

Se recomienda actualizar su inventario del hogar al menos una vez al a o, o cada vez que realice una compra significativa o adquiera nuevos art culos.

Do I need a physical or digital home inventory?

Tanto los inventarios f sicos como digitales son efectivos. Sin embargo, tener un inventario digital puede facilitar su actualizaci n y acceso en caso de una emergencia.

Is it necessary to have a home inventory if I have insurance?

S , es necesario tener un inventario del hogar incluso si tiene seguro. Esto puede ayudar a asegurar que tenga una cobertura adecuada y hacer que el proceso de reclamaciones sea m s fluido en caso de p rdida.