10 Essential Tips for Choosing Home Insurance

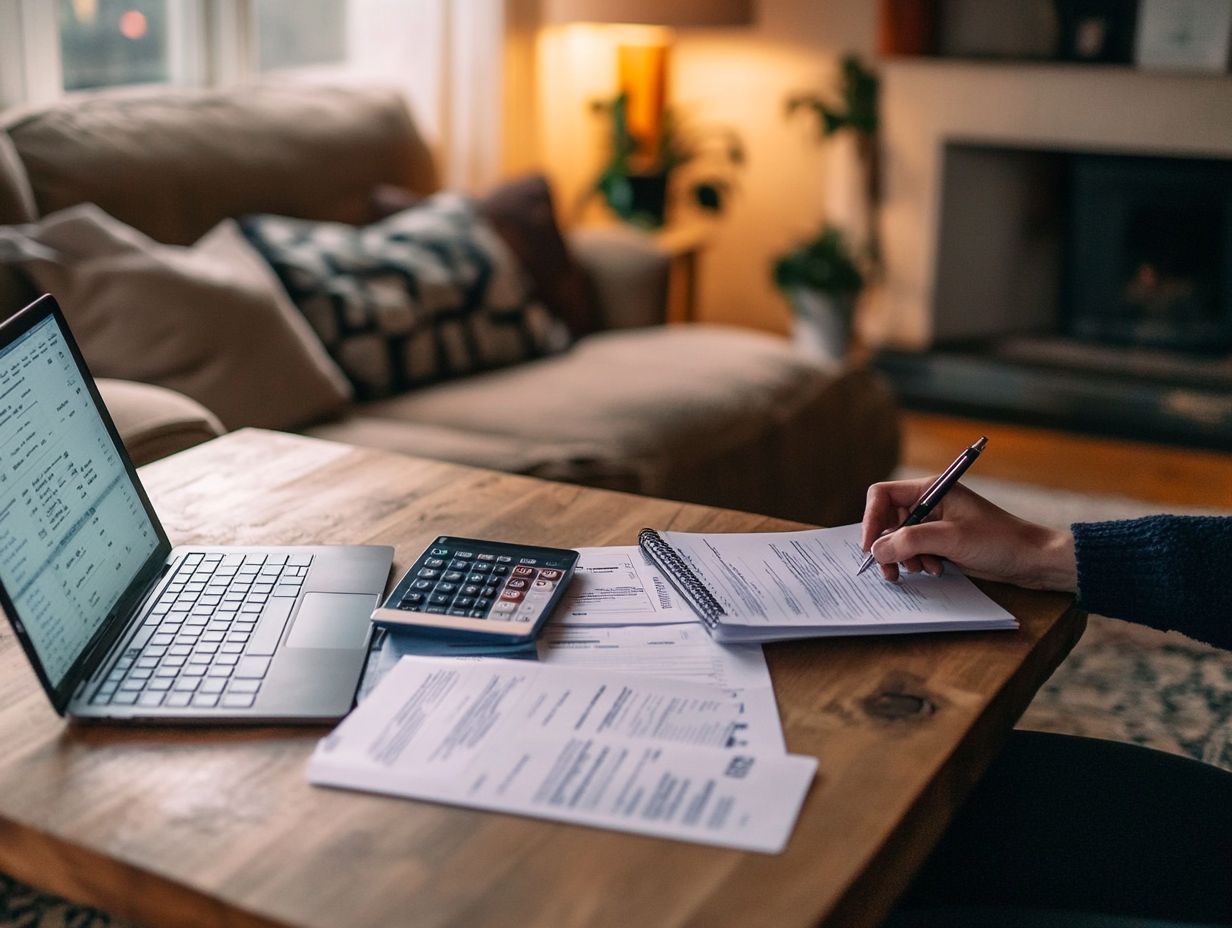

Navigating the world of home insurance can feel overwhelming, especially with the many options and factors to consider. Whether you’re a first-time homeowner or looking to refine your existing policy, it’s essential to understand your needs and the coverage available to you.

This guide presents ten essential tips to help you assess your home’s value, compare insurance providers, and find the best coverage for your situation. It also highlights common pitfalls to avoid and offers strategies for lowering your premiums.

Start reading now to become a savvy insurance shopper today!

Contents

- Key Takeaways:

- 1. Assess Your Home’s Value and Insurance Needs

- 2. Understand the Different Types of Home Insurance Coverage

- 3. Research and Compare Insurance Providers

- 4. Check the Insurance Company’s Reputation and Finances

- 5. Look for Discounts and Bundling Options

- 6. Know Your Policy Details and Exclusions

- 7. Evaluate Customer Service and Claims Process

- 8. Consider Coverage Options for High-Value Items

- 9. Take Inventory of Your Belongings

- 10. Review and Update Your Policy Regularly

- Avoid Common Home Insurance Mistakes

- Frequently Asked Questions

Key Takeaways:

Assess your home’s value and understand your insurance needs before choosing a policy. Familiarize yourself with 5 tips for selecting home insurance types. Research and compare different insurance providers to find the best fit for your needs and budget.

1. Assess Your Home’s Value and Insurance Needs

Assessing your home’s value and insurance needs is a crucial first step in securing the right homeowners insurance. This ensures you have sufficient coverage tailored to your unique requirements.

To navigate this process effectively, evaluate your personal property, consider dwelling coverage, and understand the specific risks your home may face, such as fire, flood, and earthquake. Additionally, using 5 tips for comparing home insurance providers can help you make informed decisions.

An accurate assessment helps you determine your policy limits and aids in selecting the best insurance provider that aligns with your financial and coverage goals.

Several key factors influence your property’s worth, including:

- Its location within a desirable community

- The overall size of the living space

- The condition or age of the home

Conducting a thorough risk assessment is vital to identify potential vulnerabilities to natural disasters like floods and earthquakes. Evaluate local hazard maps and historical data to accurately gauge risks.

By seeking multiple insurance quotes based on these assessments, you can uncover the most competitive rates, ensuring your coverage reflects the true value and risk profile of your home.

2. Understand the Different Types of Home Insurance Coverage

Understanding the various types of homeowners insurance coverage is crucial for effectively protecting your home and assets. Options include dwelling coverage, liability coverage, and extra living expenses.

Each component plays a pivotal role in safeguarding against unforeseen events. For example, dwelling coverage insures the physical structure of your home against damage from incidents like fire or storms.

Liability coverage protects you from claims arising from injuries on your property, while extra living expenses cover costs like hotel stays or meals when your home is uninhabitable due to a covered event.

You might also consider extra coverage options that add to your basic policy. These offer tailored solutions for specific needs, such as protecting valuable items like jewelry or artwork, ensuring you have a more comprehensive safety net.

3. Research and Compare Insurance Providers

Researching and comparing insurance providers is essential when searching for the right homeowners insurance policy. It’s important to know 5 things to know before buying home insurance. This process ensures you secure competitive quotes and allows you to evaluate the claims process and customer service capabilities of each provider.

Financial stability is another critical factor to consider when selecting an insurance provider. Utilizing resources like J.D. Power and AM Best ratings can greatly assist you in this evaluation. These ratings provide valuable insights into each company’s financial health and customer satisfaction levels, empowering you to make informed choices.

It’s vital to compare not only premiums but also the coverage options available. Assess the overall reputation of each company in the market. A thorough analysis will guide you toward reliable protection for your home and help you avoid common pitfalls, such as those outlined in the 5 mistakes to avoid when buying home insurance, giving you the peace of mind you deserve.

4. Check the Insurance Company’s Reputation and Finances

It’s important to check the company’s reputation and financial health. You want to ensure they can effectively handle your homeowners insurance, especially when you need to file a claim.

Look for financial ratings from agencies like AM Best. A high rating usually means the company is financially strong and can pay claims when disasters happen.

You should also review customer satisfaction ratings. Look for high scores that show the company responds well to claims and has positive client feedback.

5. Look for Discounts and Bundling Options

Finding discounts can significantly lower your homeowners insurance costs. Ask about discounts linked to a claims-free history or home safety features.

Insurance companies often offer various discounts. For example, you could save by bundling your homeowners insurance with auto insurance.

If you have security devices or smoke detectors, check for safety device discounts. Review your safety measures to see how they might earn you lower rates.

Bundling policies simplifies management and can lead to savings. It’s a smart choice for homeowners looking to save money.

6. Know Your Policy Details and Exclusions

Understand your homeowners insurance policy to avoid coverage gaps. For more insights, check out these 5 tips to find the best home insurance provider and pay special attention to exclusions and limits on living expenses.

Common exclusions, like floods or earthquakes, often catch people off guard. Some valuable items, like jewelry, may need extra coverage.

Read your insurance documents carefully. Look for any language that hints at limitations on your coverage.

Talking with an insurance agent can clarify confusing terms. They can help you create a coverage plan tailored to your specific risks.

7. Evaluate Customer Service and Claims Process

Evaluate the customer service and claims process of your chosen insurance company. Good support can ease the stress of filing claims.

When emergencies happen, having a responsive team is invaluable. Exceptional customer service means knowledgeable representatives who are empathetic and ready to guide you.

Efficient claims handling reduces the time you wait for compensation. This can help ease anxiety during challenging times.

Read reviews and testimonials from past customers to gauge the quality of service. These insights reveal important details about your potential insurance provider.

8. Consider Coverage Options for High-Value Items

Consider coverage options like a personal articles floater for your valuable items. This ensures your homeowners’ insurance policy provides the protection you need beyond standard limits.

This type of coverage is essential if you own jewelry, fine art, or rare collectibles. These items often exceed typical insurance limits.

Imagine suffering losses from a fire or theft without proper coverage. For art collectors, the difference between financial recovery and loss hinges on the coverage you choose.

If you have inherited valuable heirloom jewelry, having the right coverage ensures your sentimental and monetary investments are protected.

9. Take Inventory of Your Belongings

Creating a home inventory and keeping careful records is essential for making claims easier. This ensures your property is accurately represented in case of loss.

Compile a detailed list of items and their values to reduce stress during tough times. Using digital tools or apps can help you catalog belongings conveniently.

Take clear photos of each item and keep receipts. Staying organized helps simplify claims and assess the total value for insurance.

10. Review and Update Your Policy Regularly

Regularly reviewing and updating your insurance policy is vital to meet your current needs. Ensure it accurately reflects your home assets to minimize financial loss.

Homeowners should review their policy at least once a year or when significant life changes occur, like renovations or acquiring valuable items. These events can change your coverage needs.

When reaching out to your provider, clearly state any changes and provide necessary documents. This way, you ensure your policy provides the best protection.

Avoid Common Home Insurance Mistakes

Steering clear of mistakes in homeowners insurance is crucial. To protect yourself, consider the 7 mistakes to avoid when buying home insurance, as these errors can lead to insufficient coverage and financial loss during unexpected events.

Many underestimate their coverage needs, thinking a basic policy is sufficient. This can be costly when disaster strikes.

Neglecting policy exclusions can leave you vulnerable to situations you thought were covered, like flood damage. Also, failing to shop around for rates can mean missing better options.

Reassess your coverage annually. Consult knowledgeable agents and compare quotes to ensure you have the protection you need.

Factors Affecting Home Insurance Cost

Several factors impact homeowners insurance premiums. Understanding these, along with the 5 essential considerations for home insurance policies, can help you choose a provider wisely.

Your location significantly affects costs; homes in disaster-prone or high-crime areas usually have higher premiums. The age of your home also matters, as older properties may present more risks.

A claims-free history shows insurers you manage risk well. By upgrading safety features and maintaining your property, you can reduce insurance costs.

How Can a Homeowner Determine the Adequate Coverage Amount?

Determining the right coverage amount for your homeowners insurance is all about carefully assessing your dwelling needs and the total value of your home assets. Ensure you have solid financial protection against potential losses.

Start by evaluating the replacement costs of your property. Calculate how much it would cost to rebuild your home using today s materials and labor.

Next, creating a detailed inventory of your home is crucial. This should include everything from furniture to electronics, giving you a clear picture of what your belongings are worth.

It’s also important to seek multiple insurance quotes from reputable providers. This not only allows you to compare policies but also helps you grasp the nuances of the coverage options available. Make sure to select one that perfectly aligns with your specific needs.

What Are the Steps to Take When Making a Home Insurance Claim?

Know the steps to make your claim easier and faster. Documenting the damage thoroughly is essential.

- Start by taking clear photographs and creating a detailed list of affected items.

- Next, reach out to your insurance provider as soon as possible; they ll help you navigate the specifics of your policy and outline the next actions you should take.

- Keeping meticulous records of all communications is crucial; jot down the date, time, and names of the representatives you speak to, just in case any disputes come up down the line.

- Remember, acting promptly can significantly influence the outcome.

- If there are any safety concerns, don t hesitate to utilize emergency services to tackle immediate hazards.

How Can a Homeowner Lower Their Home Insurance Premium?

Lower your home insurance premiums with a few simple strategies, such as comparing premiums, opting for a higher deductible, and utilizing tips for understanding home insurance jargon to make informed decisions about discounts available for home safety features.

By enhancing your home’s overall security think advanced alarm systems and motion-sensor lighting you not only reduce the risk of theft or damage but also make your property more appealing to insurers. Maintaining a clean claims history is equally essential; frequent claims can drive your rates up.

Taking the time to research various offers from different insurance providers allows you to uncover competitive deals tailored specifically to your needs. This ultimately leads to greater savings.

By combining these strategies, you create a comprehensive approach to minimizing your insurance costs, ensuring you get the best value for your investment.

What Are the Different Payment Options for Home Insurance?

Exploring the various payment options for homeowners insurance can offer you financial flexibility and help you budget effectively for your insurance premiums throughout the policy term.

Many insurance providers present a range of payment plans, letting you choose between monthly, quarterly, or annual payments.

- Monthly payments can lighten the financial load, making it easier to slot into your budget, but keep in mind they might come with extra fees over time.

- Quarterly payments strike a nice balance, offering a compromise between upfront costs and convenience.

- On the flip side, annual payments often come with a discount, rewarding you for paying your premiums in one go. However, this option requires a larger upfront payment, which may not suit everyone s financial situation.

Ultimately, understanding these options gives you the power to select a plan that aligns with your financial strategies and preferences. This ensures you feel confident in your insurance decisions.

Frequently Asked Questions

What are the 10 essential tips for choosing home insurance?

The 10 essential tips for choosing home insurance are:

- Assess your needs and coverage options.

- Compare quotes from multiple insurance providers.

- Combine your home and car insurance for discounts.

- Review the insurance company’s reputation and financial stability.

- Understand the different types of coverage available.

- Take advantage of available discounts!

- Read and understand your policy details.

- Consider extra coverage based on your location.

- Consult with an insurance agent for personalized help.

- Regularly review and update your policy as needed.

Assessing your needs helps you find the right coverage for your home and belongings. This can save you money by avoiding unnecessary expenses.

Comparing quotes helps you discover the best coverage options and prices. You can then choose a policy that fits both your budget and your needs.

Combining your home and car insurance can lead to discounts. It also makes managing your insurance straightforward.

Checking the insurance company’s reputation ensures they can meet their promises. This protects your investment and provides peace of mind.

Types of coverage include dwelling, personal property, liability, and additional living expenses. Understand what each covers to determine your needs.

Your home insurance premiums can be affected by various factors. These include your home’s age, location, claims history, and the coverage you select.