What to Expect During a Home Insurance Inspection?

Home insurance inspections might feel intimidating, but they are an essential step in securing the optimal coverage for your property.

This article provides a comprehensive overview of everything you need to know, from grasping the importance of these inspections to preparing effectively for them.

Discover what inspectors typically look for, identify common problem areas that could affect your policy, and understand what to expect once the inspection wraps up.

With these insights for a successful inspection, you can approach the process with confidence, ensuring a favorable outcome.

Contents

- Key Takeaways:

- Understanding Home Insurance Inspections

- Preparing for a Home Insurance Inspection

- What the Inspector Will Look For

- Potential Issues that Could Affect Your Insurance

- What Happens After the Inspection?

- Tips for a Successful Inspection

- Frequently Asked Questions

- What should I expect during a home insurance inspection?

- Do I have to be present for the home insurance inspection?

- What areas of my home will be inspected?

- How long does a home insurance inspection usually take?

- Will my home insurance premium be affected by the inspection?

- What should I do to prepare for a home insurance inspection?

Key Takeaways:

- Home insurance inspections ensure the safety of your home.

- Prepare by fixing issues and gathering documents.

- Inspectors will look at the roof, plumbing, and electrical systems.

Understanding Home Insurance Inspections

Home insurance inspections are essential evaluations carried out by certified inspectors. They assess your property’s condition, which shapes your home insurance policy.

These thorough inspections examine vital elements such as the replacement cost of your home and structural concerns. They also evaluate safety features, enabling you to prepare for potential risks associated with natural disasters like hurricanes and earthquakes.

In high-risk areas, these assessments are critical for determining appropriate insurance coverage and can significantly influence your monthly premiums.

Why They Are Required

Home insurance inspections help you mitigate both insurance and liability risks associated with your property. They ensure that your insurance policy accurately reflects your home s current condition and value.

These inspections allow insurance companies to assess potential hazards that could lead to expensive damages, such as structural issues or outdated electrical systems.

By identifying these vulnerabilities, insurers can evaluate risks more effectively and customize coverage plans accordingly. This often results in adjustments to your insurance premiums.

For homeowners, understanding the importance of these inspections empowers you to enhance your home s safety features and potentially lower your premiums over time.

Preparing for a Home Insurance Inspection

Preparing for a home insurance inspection requires several proactive steps to ensure your property meets your insurance company s requirements.

By doing so, you can enhance the likelihood of receiving favorable evaluations, which may even lead to lower premiums.

Steps to Take Before the Inspection

Before your home insurance inspection, tackle some essential maintenance tasks and gather relevant documentation for a smooth appraisal process.

Start by checking your heating, ventilation, and air conditioning (HVAC) systems to confirm they re running efficiently. Inspect your plumbing for any leaks or issues, and regularly test your fire safety measures, such as smoke detectors and fire extinguishers.

These steps are vital for safeguarding your home and can significantly impact its appraisal value. Keeping detailed records of repair costs and improvements not only provides valuable insights during evaluations but also highlights your property s upkeep, which could lead to lower insurance premiums.

Neglecting these aspects could compromise both your home s value assessment and the comprehensiveness of your insurance plan.

What the Inspector Will Look For

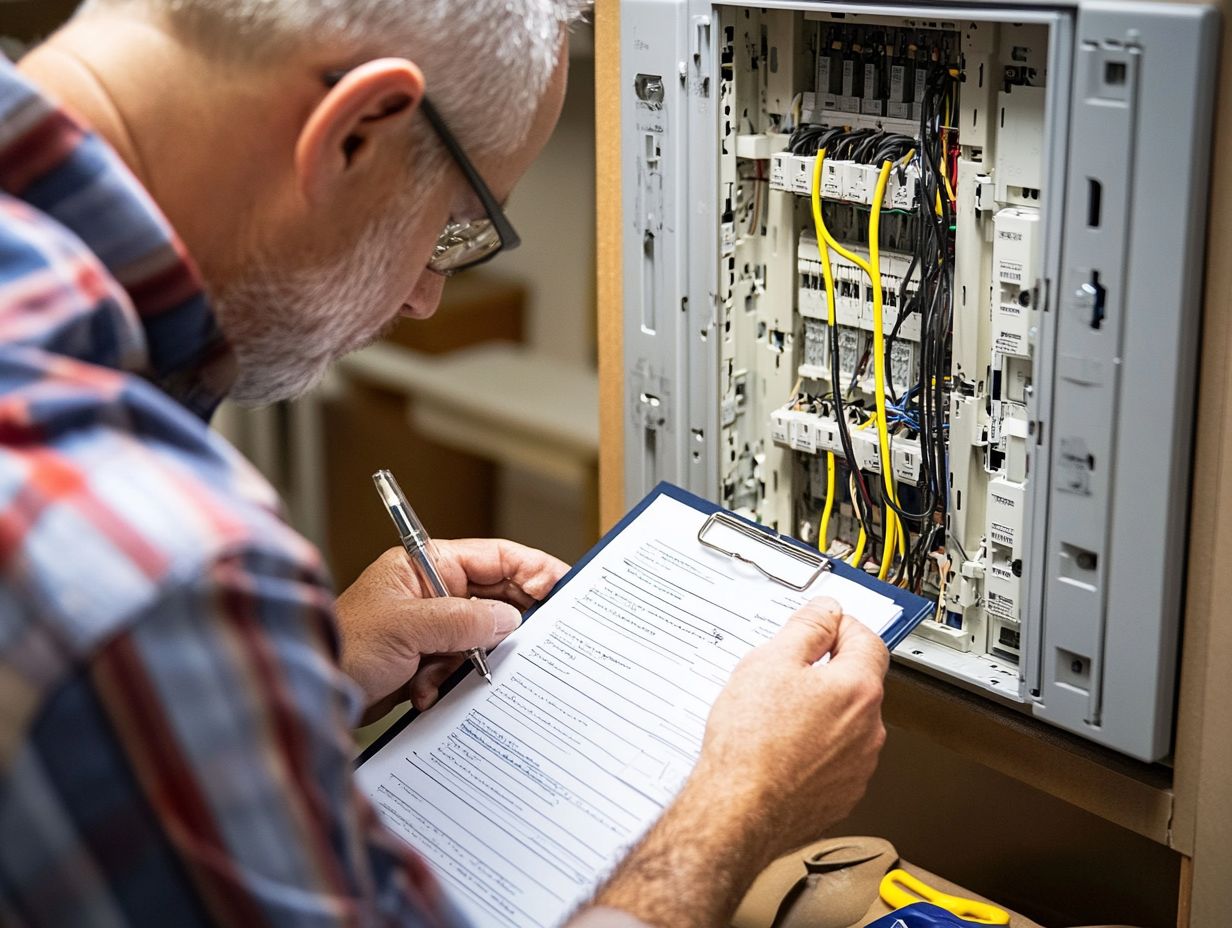

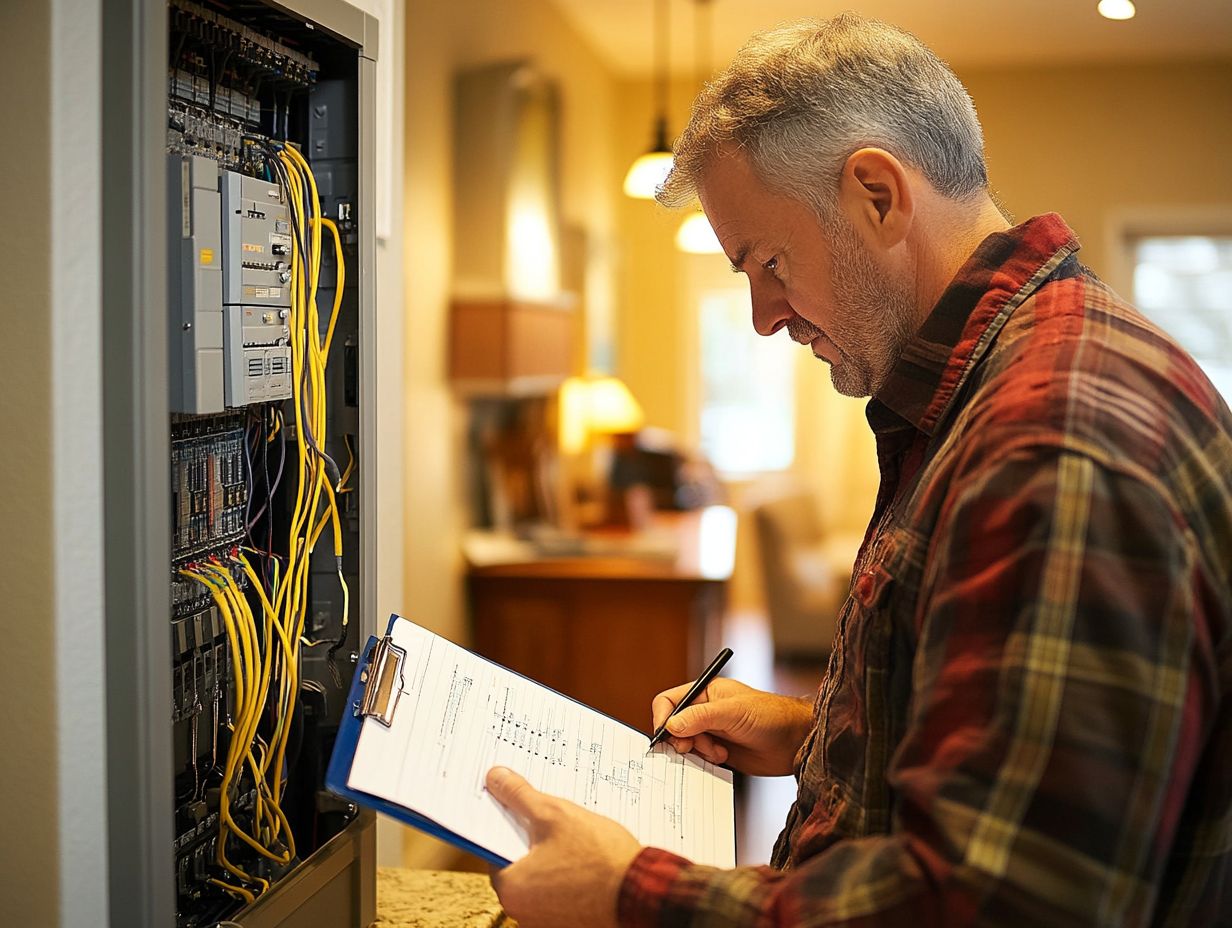

During a home insurance inspection, get ready for a thorough evaluation by a certified inspector. This process involves meticulous inspections of both the interior and exterior of your property, aimed at identifying any potential structural issues, assessing the safety systems in place, and determining what to expect from home insurance claims to ensure your coverage is sufficient for your needs.

Start preparing today for a successful home insurance inspection!

Common Areas of Focus

During a home insurance inspection, pay attention to common focal points. These include the functionality of fire alarms and security systems, potential pest damage, and wind mitigation measures.

These inspections dive deeper into how these aspects influence the insurer’s risk assessment. Ultimately, this affects the premiums you might face.

A well-functioning fire alarm system enhances safety. It can also lead to lower insurance premiums by reducing the likelihood of fire-related claims.

If any pest damage is found, address it through recommended improvements. Proper sealing and regular treatments could lead to a more favorable evaluation.

Wind mitigation measures like strong roofing and reinforced structures show your proactive approach. This can lower perceived risk and potentially reduce your insurance costs.

Each of these areas can elevate your profile with insurers and ultimately benefit your finances.

Potential Issues that Could Affect Your Insurance

Identify potential issues during a home insurance inspection. These concerns can lead to claims and changes in your policy.

This can significantly impact your coverage and costs as a homeowner.

Identifying and Addressing Problem Areas

Identifying and addressing problem areas during a home insurance inspection can mitigate liability risk and enhance safety. This ultimately leads to more favorable insurance evaluations.

Take a proactive approach by regularly assessing critical systems like plumbing, electrical, and structural elements. Neglecting these areas can lead to expensive repairs and increased insurance premiums.

For example, checking for leaky pipes or signs of water damage can help prevent mold growth, which is hazardous and can lead to substantial remediation costs.

Ensuring that your roof and foundation are in good condition is essential for maintaining your home’s structural integrity. By implementing these actionable strategies and remaining vigilant about potential issues, you safeguard your property.

This not only allows for prompt remediation but also translates to lower insurance costs and improved safety for your family.

What Happens After the Inspection?

Following the home insurance inspection, you can anticipate receiving a detailed report that highlights the findings.

This report will impact your insurance policy and potential renewal. It also plays a crucial role in ensuring your overall compliance with insurance requirements.

Possible Outcomes and Next Steps

Possible outcomes following a home insurance inspection may require you to make necessary adjustments based on the inspector’s findings. It s essential to document and address these to ensure compliance with your insurance policy.

You may need to schedule repairs for any issues the inspector identifies. Taking care of these problems can help prevent future claims and preserve your property’s value.

Be mindful that these inspections might lead to increased premiums if higher risks are uncovered or if significant changes occur to your property. Staying proactive about updating your policy with any renovations or upgrades is crucial to ensure your coverage accurately reflects your home s current state.

Thorough documentation can be a powerful ally, aiding in potential negotiations and serving as vital evidence for future evaluations.

Tips for a Successful Inspection

To achieve a successful home insurance inspection, prioritize meticulous preparation. Adhere strictly to insurance requirements and engage in proactive home maintenance.

This approach enhances the safety of your property and positively impacts overall evaluations.

How to Ensure a Positive Outcome

To ensure a positive outcome from your home insurance inspection, you need to prioritize regular home maintenance and address any potential structural issues. Have all relevant homeowner documentation ready for review.

Boost your property s appeal by performing a thorough walkthrough of your residence. Identify and fix any signs of wear and tear, such as cracked foundations or leaking roofs.

By implementing regular upkeep on essential systems like plumbing and electrical, you significantly bolster your home s value and safety.

Keeping detailed records of repairs and improvements gives you the power during the inspection. This showcases your commitment to maintaining the integrity of your home. Proactive measures mitigate risks and create a favorable impression that can influence insurance evaluations in your favor.

Frequently Asked Questions

What should I expect during a home insurance inspection?

During a home insurance inspection, the insurance company will send a representative to assess the condition and potential risks of your home. They will examine the interior and exterior of your home, as well as any other structures on your property, such as a garage or shed.

Do I have to be present for the home insurance inspection?

It is not necessary for you to be present during the inspection, but it is recommended. This allows you to ask questions and address any concerns that may arise.

What areas of my home will be inspected?

The insurance inspector will typically examine the roof, foundation, electrical system, plumbing, and Heating, Ventilation, and Air Conditioning (HVAC) system. They may also check for potential hazards such as fire risks or security issues.

How long does a home insurance inspection usually take?

The duration of a home insurance inspection can vary depending on the size and condition of your home, but it typically takes between 1 to 2 hours to complete.

Yes, the results of the inspection can impact your home insurance premium. If the inspector identifies potential risks or hazards, your premium may increase. Conversely, if your home is deemed low risk, you may be eligible for a lower premium.

What should I do to prepare for a home insurance inspection?

To prepare for a home insurance inspection, ensure your home is clean and tidy, and all areas are easily accessible. It is also helpful to have necessary documents, such as home maintenance records, on hand for the inspector to review.