Do You Need Home Insurance for a Vacant Home?

If you own a vacant home, you may find yourself questioning the importance of home insurance and the coverage options available to you. A vacant property presents a unique set of risks and liabilities, leaving you exposed without adequate protection.

This article delves into what defines a vacant home, why insurance is necessary, the various types of coverage you can consider, and the steps to secure the right policy for your situation. It also discusses alternatives to traditional coverage, ensuring your property remains well protected.

Whether you’re a landlord, a homeowner in transition, or an investor, understanding your insurance needs for a vacant home is essential.

Contents

Key Takeaways:

Vacant homes are properties that are unoccupied for an extended period, typically 30-60 days depending on the insurance policy. Having home insurance for a vacant home can protect you from potential risks and liabilities, such as vandalism, theft, or damage caused by natural disasters.

There are various types of home insurance available for vacant homes, including vacant dwelling insurance, builder’s risk insurance (which covers properties under construction), and vacant land insurance. Consider the options and coverage benefits before choosing the best one for your needs.

Understanding Home Insurance for Vacant Homes

Understanding home insurance for vacant properties is crucial for homeowners planning to leave their residences unoccupied for extended stretches. Vacant home insurance isn’t just a rebranded version of standard homeowners insurance; it specifically addresses the unique risks tied to unoccupied homes. Many insurance providers offer specialized policies designed to shield you from various risks such as theft, vandalism, and fire. This custom insurance is essential for protecting both your property and personal belongings from potential financial setbacks during your vacancy period.

What is Considered a Vacant Home?

A vacant home is a property that sits unoccupied for an extended period, typically more than 30 days, and it often lacks any personal belongings. This sets it apart from an unoccupied home, which might still have furniture and personal items.

Understanding this distinction is vital for you as a homeowner, as it significantly influences your insurance policies. For instance, if you leave your house empty while relocating for work but keep your furniture inside, your property may still be classified as unoccupied. However, if you remove all personal effects for an extended time, it risks being labeled as vacant.

Insurance policies often treat vacant properties differently, often imposing limitations or even denying coverage for events like vandalism or theft. This could lead to financial risks that you want to avoid as a property owner.

Why You May Need Home Insurance for a Vacant Home

Home insurance for a vacant property is essential, given the numerous risks and liabilities that arise when a home sits unoccupied. For those wondering about coverage, it’s important to know if home insurance covers vacation homes. From potential damage due to natural elements to the threats of theft and vandalism, the financial risks can be huge if you’re not adequately protected.

Most standard homeowners insurance policies don t extend coverage to vacant homes, which is why it s imperative to secure a policy specifically designed for these circumstances.

By comprehending the risks associated with leaving a property vacant, you can make informed decisions tailored to your insurance needs.

Don t leave your vacant home unprotected! Explore your insurance options today.

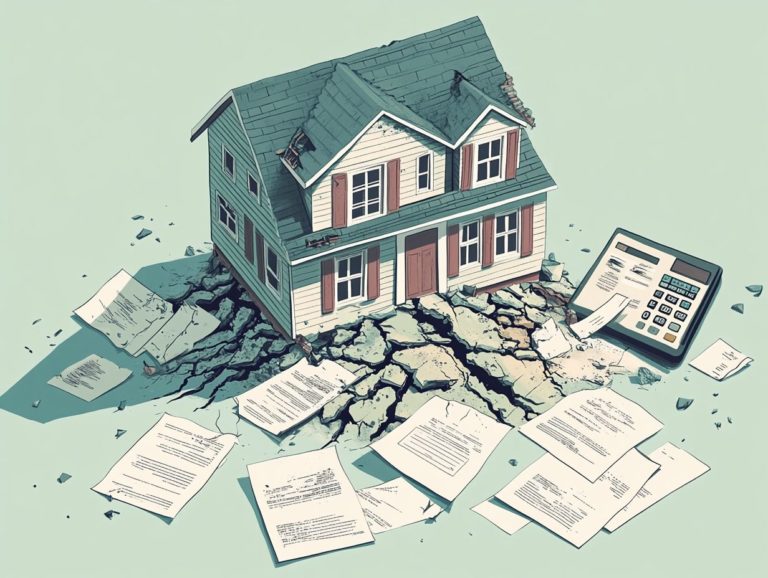

Risks and Liabilities of Vacant Homes

Vacant homes can lead to various risks, including property damage from weather events, theft, and vandalism. If you re not properly insured, these issues can result in significant liabilities and financial loss.

Fire hazards are another concern, arising from neglected utilities or even the threat of arson. With natural disasters like hurricanes and floods becoming more common, now is the time to evaluate your insurance plans carefully!

These risks not only cause steep repair costs but also significantly affect your liability coverage and insurance rates. Without the right policies, the financial fallout can be devastating.

If you’re considering a vacant property, understanding the importance of comprehensive insurance solutions is vital.

Types of Home Insurance for Vacant Homes

You ll find various home insurance options specifically designed for vacant homes, each tailored to meet the unique risks you may face as a homeowner.

Vacant home insurance policies offer specialized coverage that standard homeowners insurance often overlooks. Many insurance companies provide add-ons that help customize your coverage and ensure protection against specific threats related to vacant properties.

Understanding these insurance options is crucial for homeowners wanting to mitigate potential risks while their property is unoccupied.

Options and Coverage Benefits

Options for vacant home insurance come with a variety of coverage benefits, including protection against property damage, liability coverage for accidents on your property, and financial loss protection against theft and vandalism. Understanding your policy is vital to protecting your property!

These coverage benefits are significant when unexpected events arise, such as a fallen tree damaging your roof during a storm or a guest slipping on an icy walkway and filing a liability claim. Property damage coverage can help manage repair costs, while liability coverage acts as a buffer against potential lawsuits, easing your financial anxiety.

In the unfortunate event of theft or vandalism, knowing the limits of your financial loss protection can provide reassurance. These policies are designed to protect against the myriad risks associated with vacant properties, giving you the peace of mind you deserve.

How to Get Home Insurance for a Vacant Home

Securing home insurance for a vacant property requires careful consideration of multiple factors, including the choice of insurance provider, the specifics of the policy, and the unique risks tied to the property.

Each provider offers a variety of coverage options designed for vacant homes. Assess your needs, compare insurance rates, and engage in meaningful conversations with insurance agents.

This approach ensures you select the right policy that adequately protects your vacant home.

Factors to Consider and Steps to Take

When considering home insurance for a vacant property, keep several key factors in mind: the risk profile of your home, the reputation of the insurance provider, coverage limits, and insurance rates, which can fluctuate significantly based on the condition and location of the property.

How long your property will be vacant matters. It’s advisable to assess your property’s specific vulnerabilities, such as proximity to flood zones or areas with high crime rates, as these can significantly impact your insurance premiums.

Maintaining the property in good repair is a smart move; a well-kept home could lead to more favorable rates. If you anticipate an extended vacancy, inform your insurer in advance and explore specialized policies designed for unoccupied homes.

Regular inspections and maintenance can further reduce risks, positioning you for a better insurance plan.

Alternatives to Traditional Home Insurance for Vacant Homes

Finding the right insurance for vacant homes is crucial. Options like vacant home insurance or builders risk insurance can meet your specific needs.

These solutions protect properties during important transitions. They give you peace of mind while renovations or repairs are underway.

Other Coverage Options

Consider additional liability protection and coverage for personal belongings left on the property. You might even get discounts for installing security systems.

Enhance your policy with add-ons that address unique challenges, like coverage for vandalism or accidental damage.

Implementing security measures, like motion-sensor lights, can deter intruders. This also helps you enjoy lower premium rates, saving you money in the long run.

It shows insurers you care about protecting your home.

Frequently Asked Questions

Yes, it’s highly recommended to have home insurance for a vacant home. Even when not in use, the home is still vulnerable to damage or loss.

A vacant home is one that isn t occupied by its owner or tenants. This may be due to being for sale, undergoing renovations, or waiting for new tenants.

Most regular home insurance policies don t cover vacant homes. Check with your provider for specific options.

Without insurance, your home is at risk of vandalism, theft, and natural disasters. You’ll bear the financial burden of repairs without coverage.

It’s not advisable to cancel your insurance. Keep it active to ensure coverage for unexpected events.

Yes, insurers often have specific requirements for vacant homes. This may include regular inspections and security measures.