Can I Switch Home Insurance Providers Anytime?

Home insurance is important for you as a homeowner. Safeguarding your most valuable asset is crucial, but wading through the myriad of policies and providers can feel daunting.

This article lays out everything you need to know about home insurance. It covers the different types of coverage available and the reasons you might consider switching providers.

It delves into when making a change is appropriate, provides a step-by-step guide on how to switch, and highlights key factors to consider before you take the plunge.

Whether you’re aiming to save money or secure better coverage, this guide empowers you to make informed choices about your home insurance.

Contents

- Key Takeaways:

- Understanding Home Insurance Policies

- Reasons for Switching Home Insurance Providers

- When You Can Switch Home Insurance Providers

- How to Switch Home Insurance Providers

- Considerations Before Switching

- Frequently Asked Questions

- Can I Switch Home Insurance Providers Anytime?

- What is the process for switching home insurance providers?

- Will I be charged a cancellation fee for switching home insurance providers?

- Can I switch home insurance providers mid-way through my policy term?

- What happens to my coverage when I switch home insurance providers?

- Are there any benefits to switching home insurance providers?

Key Takeaways:

You can switch your home insurance anytime! But remember to check coverage, cost, and service first.

Common reasons for switching home insurance providers include finding a better deal, dissatisfaction with current coverage, or changes in circumstances like moving or renovating.

Before switching, make sure you understand the timeframes and restrictions for cancelling your current policy and starting a new one.

Consider reaching out to a trusted insurance agent for guidance.

Understanding Home Insurance Policies

Home insurance is important for homeowners like you who are seeking financial protection and peace of mind for your most valuable asset.

A comprehensive homeowners insurance policy offers coverage options tailored to your individual needs. This helps you mitigate risks associated with unexpected events like fire, theft, or natural disasters.

By grasping the various components of your insurance policy such as coverage limits, premium payments, and potential discounts you can make informed financial decisions that safeguard your property and personal belongings.

Working with insurance experts can improve your experience and enhance customer satisfaction.

Types of Home Insurance Coverage

Homeowners insurance typically includes a variety of coverage options designed to shield you from a range of risks. This encompasses dwelling coverage, personal property coverage, and additional living expenses each of which can be crucial in the event of a catastrophic loss.

Every type of coverage plays a vital role in protecting your home and belongings. For example, dwelling coverage safeguards the structure of your home, covering everything from walls to the roof and built-in appliances.

On the other hand, personal property coverage extends to your valuables, such as furniture, electronics, and clothing. If your home becomes uninhabitable due to a covered incident, additional living expenses will help offset the costs of temporary housing.

Don t miss out on endorsements! They can give your policy extra protection against specific risks, like natural disasters or valuable collections.

Understanding the claims process is equally important. Knowing how to file a claim and what documentation is required can significantly influence the outcome. Being aware of common exclusions such as damage from floods or earthquakes can help you avoid misunderstandings when it comes time to file a claim.

Reasons for Switching Home Insurance Providers

Switching home insurance providers can be a smart decision for homeowners seeking enhanced financial protection, reduced premiums, and superior customer service.

It also allows you to tailor your policy to meet your evolving coverage needs and personal preferences.

Ready to explore your home insurance options? Start comparing quotes today to find the best deal for you!

Common Motivations for Changing Providers

Common reasons for changing home insurance providers often stem from a desire for better customer satisfaction, competitive premium rates, and access to improved coverage options and discounts that align with your financial goals.

You might find yourself feeling dissatisfied with your current provider due to sluggish claims processes or unresponsive customer support. This could prompt you to explore alternative options. Financial changes, such as starting a new job or shifts in family dynamics, can significantly impact your coverage needs, leading you to seek policies that better fit your evolving budget.

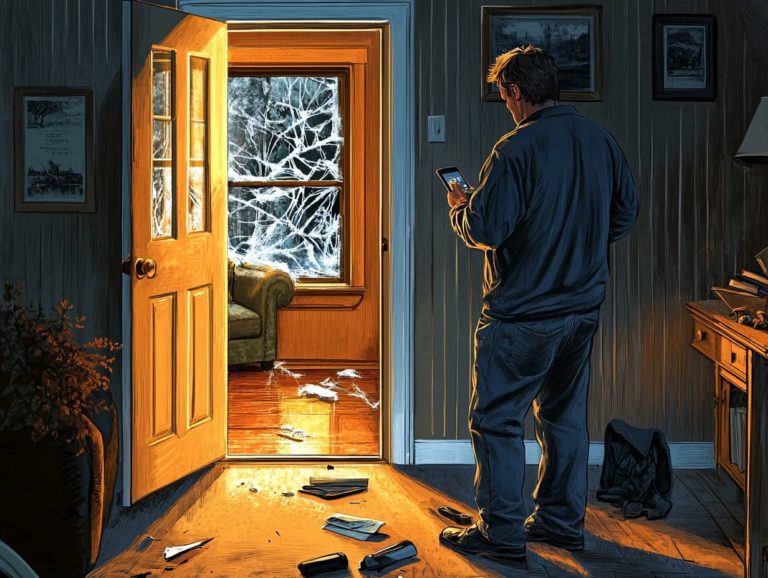

Life events, like relocating or renovating your home, can also necessitate a thorough reassessment of your existing policies to ensure they adequately protect your new investment.

All these factors encourage a more thoughtful approach to securing comprehensive and cost-effective home insurance that truly meets your needs.

When You Can Switch Home Insurance Providers

Homeowners have the opportunity to switch their home insurance providers at strategic moments, typically aligning this decision with policy renewal dates or significant life changes. Learning how to switch home insurance providers smoothly ensures a seamless transition, allowing them to avoid any penalties or disruptions in coverage during the process.

Timeframes and Restrictions

Understanding the timeframes and restrictions involved in switching home insurance providers is crucial for you as a homeowner. This knowledge helps avoid gaps in coverage and potential penalties tied to cancellation policies.

You ll need to carefully navigate the required notice periods, which typically range from 30 to 60 days, depending on the terms of your existing policy. It s important to align the effective dates of your new policies to ensure there s no lapse in coverage.

Keep in mind that restrictions may also hinge on your insurance history; for instance, if you have prior claims, you might face higher premiums or a more limited selection of options. Additionally, mortgage lenders often impose specific guidelines regarding escrow accounts, which are used to manage your insurance payments, and this can affect how your premiums are managed and paid.

This shows why you should consult your insurance agents and lenders before making any transitions.

How to Switch Home Insurance Providers

Switching home insurance providers requires a thoughtful approach. You ll want to begin by assessing your coverage needs, ensuring you have a clear understanding of what you require. This means understanding how much coverage you need to feel secure.

Next, take the time to compare quotes from different insurance companies, carefully evaluating each option.

Finally, ensure that the new policy aligns perfectly with your financial protection requirements, providing you with the peace of mind you deserve.

Step-by-Step Guide

A structured step-by-step guide to switching home insurance providers will empower you to navigate the process with ease, ensuring you secure the best coverage limits and financial protection available.

By following a clear roadmap, you can deepen your understanding of various insurance products specifically tailored to meet your unique needs. Your journey typically begins with researching different insurance companies, where assessing their reputation and customer service ratings is crucial.

Once you have established a shortlist, obtaining quotes becomes the next essential step; this allows you to directly compare pricing and coverage options. Evaluating these quotes requires your careful attention to detail, as understanding what is covered and what isn t can significantly impact your future claims.

Being well-versed in cancellation policies is necessary to prevent any lapses in coverage. Ultimately, making informed decisions based on thorough evaluations will align with your financial objectives, creating a safer living environment for you and your loved ones.

Considerations Before Switching

Before switching providers, it’s essential to thoughtfully evaluate several key factors. Consider your specific coverage needs, reflect on your insurance history, and take into account your past customer service experiences.

Additionally, weigh the financial implications of your decision to ensure you’re making the most informed choice.

Don’t miss the chance to find a policy that works for you. Start your journey today and explore your options!

Remember, the right home insurance can make all the difference. Start exploring your options today!

Factors to Keep in Mind

If you’re thinking about switching home insurance providers, focus on a few key factors. Consider your protection needs, insurance history, and the quality of customer service from potential new insurers.

You must also evaluate how much protection you get. Different policies offer different levels of coverage against common risks.

Knowing how to file a claim is crucial too. You want to be sure your new insurer manages claims efficiently to keep stress low during tough times.

Excellent customer service is essential. It provides vital support and guidance when you need it most.

Compare quotes carefully to find the best deal. This will help you choose a plan that fits your needs and budget.

Frequently Asked Questions

Can I Switch Home Insurance Providers Anytime?

Yes, you can switch home insurance providers whenever you want. Just make sure you have a good reason and consider whether you can change your home insurance policy to better suit your needs.

What is the process for switching home insurance providers?

Switching home insurance providers is simple. First, cancel your current policy, then find a new provider and apply for a new policy.

Be sure to compare policies and prices before making your decision.

Will I be charged a cancellation fee for switching home insurance providers?

It varies by provider. Some may charge a cancellation fee while others may not. Always read the terms of your policy to know any potential fees.

Can I switch home insurance providers mid-way through my policy term?

Yes, you can switch during your policy term. However, you might pay a pro-rated premium for the time you’ve been covered.

Check with your current provider about their specific cancellation policy.

What happens to my coverage when I switch home insurance providers?

Your coverage with the current provider ends once you cancel your policy. You ll need to apply for a new policy quickly to avoid gaps in coverage.

Review the coverage and terms of your new policy carefully to ensure it meets your needs.

Are there any benefits to switching home insurance providers?

Switching providers can save you money on premiums. It also allows you to find a policy that better suits your needs and offers improved coverage.

Regularly review your insurance to ensure you have the best option available!