How to Check for Gaps in Your Coverage

Insurance is essential for protecting your assets and well-being. Yet, many individuals tend to overlook potential gaps in their coverage. Recognizing these gaps and their implications is vital for ensuring you re fully protected.

Let s explore the world of insurance to help you protect what matters most! This article covers various types of insurance, pinpoints common coverage gaps, and offers strategies for addressing and preventing them.

Whether you re navigating health, auto, or homeowners insurance, being informed empowers you to secure the peace of mind you truly deserve.

Contents

- Key Takeaways:

- Understanding Insurance Coverage Gaps

- Types of Insurance Coverage

- Preventing Coverage Gaps

- Frequently Asked Questions

- 1. How do I identify gaps in my coverage?

- 2. What types of coverage should I check for gaps?

- 3. What are some common examples of coverage gaps?

- 4. What are the potential consequences of having coverage gaps?

- 5. Should I review my coverage for gaps regularly?

- 6. What should I do if I identify gaps in my coverage?

Key Takeaways:

- Identify coverage gaps to safeguard your finances.

- Review your insurance policies regularly.

- Consult an insurance agent to ensure you have the right coverage.

Understanding Insurance Coverage Gaps

Understanding insurance coverage gaps is crucial for securing robust financial protection. These gaps can expose you to considerable financial liability, especially concerning your vehicle’s value think of gap insurance for new or luxury cars.

Being well-informed about your insurance needs is vital for protecting your wealth and fulfilling the obligations laid out in your loan agreement. You need to understand the difference between necessary coverage and optional coverage options.

What are Coverage Gaps?

Coverage gaps are moments when your insurance policy leaves you exposed, failing to shield you from financial liability in certain situations. These gaps can emerge from insufficient policy limits, specific exclusions outlined in the terms, or misconceptions about what your policy truly covers.

For instance, your homeowners insurance might not account for certain natural disasters or specific kinds of personal property. This can lead to considerable financial strain. It s essential to grasp the difference between necessary coverage often encompassing basic liability and property damage protections and optional coverage options, like additional liability limits or specialized endorsements.

By thoughtfully addressing these gaps, you can create a more robust insurance portfolio that effectively protects your assets against the unexpected.

Types of Insurance Coverage

You ll find a range of insurance coverage options designed to address your distinct needs. From health insurance to auto and homeowners insurance, each type shields you from specific risks and liabilities.

Health Insurance

Health insurance offers critical coverage for medical expenses and serves as a cornerstone of financial security for you and your family. Understanding the structure and various types of health insurance plans is essential for making well-informed choices.

You have several options, including:

- Employer-sponsored plans

- Government programs like Medicaid and Medicare

- Individual policies tailored specifically to your needs

Each of these plans comes with different insurance premiums that can significantly impact your monthly budget. Inadequate coverage could lead to considerable financial strain during unforeseen medical situations, underscoring the importance of carefully checking your options.

This diligence ensures you secure comprehensive protection that aligns seamlessly with your health and financial objectives.

Auto Insurance

Auto insurance includes various policies designed to protect your vehicle and shield you from financial liability in the event of accidents or theft. This encompasses options like gap insurance, collision policies, and comprehensive coverage.

These types of coverage serve as essential financial safety nets, ensuring you are prepared for unforeseen expenses. Collision policies focus on damages from accidents, while comprehensive coverage extends your protection against non-collision incidents, such as vandalism or natural disasters.

If you own a brand-new car or a luxury vehicle, gap insurance is a must-have. It covers the difference between your vehicle’s market value and the remaining loan balance if the car is declared a total loss.

When assessing your policy options, it s crucial to compare various insurance providers, as premium pricing can vary significantly based on coverage limits, deductibles, and your individual risk factors.

Don t wait review your insurance today to protect your future!

Homeowners Insurance

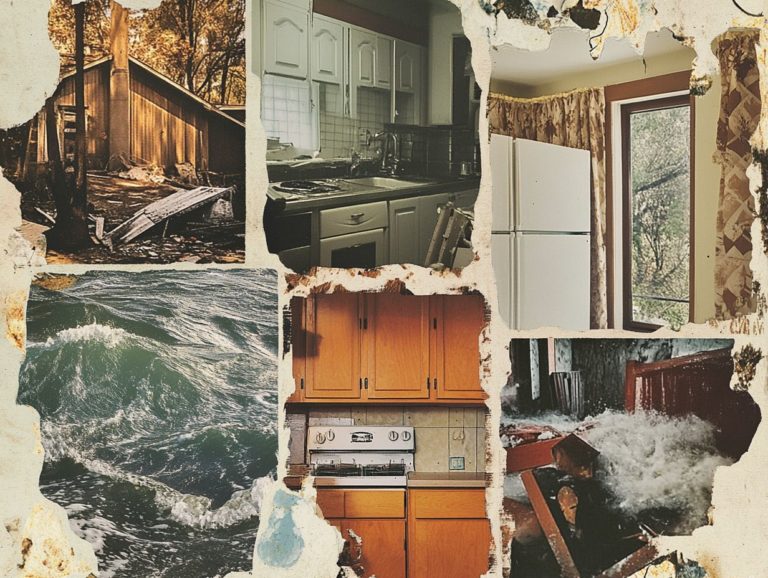

Homeowners insurance serves as a vital shield against many risks that come with owning a home, safeguarding you from financial liability related to damages to your property and personal belongings.

This type of coverage is essential, especially when you consider unexpected events like natural disasters, theft, or accidents all of which can lead to substantial out-of-pocket expenses. You must understand the details of your policy, including dwelling coverage, liability limits, and personal property protection.

Optional coverages can elevate your standard policy, offering additional security against unique risks such as flood or earthquake damage. By incorporating these options, you can create a robust financial safety net and ensure you re well-prepared to tackle potential losses.

This underscores the importance of having a comprehensive insurance plan to effectively reduce financial risk.

Identifying Coverage Gaps

Identifying coverage gaps is essential for making sure your policies protect your finances against unforeseen events. A comprehensive review of your current insurance policies will give you the power to identify any deficiencies and take proactive measures to secure your financial well-being.

Reviewing Your Policies

Regularly reviewing your policies is crucial to pinpoint potential coverage gaps that could threaten your financial stability. This process entails a thorough examination where you assess key elements like coverage limits, deductibles, and exclusions.

Begin by collecting all your insurance documents, including health, auto, home, and life insurance. Reflect on whether your current coverage aligns with any recent life changes, such as a new job, marriage, or the arrival of a child.

Don’t overlook recent purchases or property upgrades that might necessitate extra coverage. By considering these factors, you can make informed decisions about adjusting your policies, ensuring you have the right protection in place without overspending on unnecessary extras.

Common Coverage Gaps to Look Out For

Common coverage gaps can greatly impact your financial security, particularly those within various insurance policies due to exclusions or inadequate limits. These gaps often emerge in health, auto, and homeowners insurance, leaving you vulnerable during critical moments.

For example, many health plans might not cover certain preventative services or provide sufficient mental health support, forcing you to pay out-of-pocket for essential care. Likewise, auto insurance may not include rental reimbursement coverage in the event of an accident, resulting in unexpected expenses.

Homeowners insurance can also fall short by excluding damage from natural disasters like floods or earthquakes, which could lead to substantial repair costs. To mitigate these risks, it s wise to conduct a thorough review of your insurance policies and consult with professionals to ensure you have adequate coverage that genuinely meets your needs.

Addressing Coverage Gaps

Addressing coverage gaps is essential for securing the financial protection you need to navigate unforeseen circumstances. Fortunately, there are several options available to help you fill these gaps in your insurance coverage, ensuring you’re well-prepared for whatever life may throw your way.

Options for Filling Gaps

You have several options for filling gaps in your insurance coverage, such as purchasing gap insurance or opting for additional policies that enhance your existing protection. By evaluating your personal circumstances and potential risks, you can tailor your insurance portfolio to better meet your unique needs.

Gap insurance is especially advantageous if you have auto loans or leases, as it covers the difference between what you owe and the vehicle’s actual cash value in the event of a total loss. You might also want to consider optional coverage components, such as riders for specific situations like home-based business operations or increasing your liability limits for added peace of mind.

Exploring supplemental policies, like umbrella insurance, can provide enhanced coverage across multiple areas, ensuring you have a more comprehensive safety net.

Start reviewing your insurance today to ensure you’re fully covered!

Working with an Insurance Agent

Working together with an insurance agent is a strategic move to identify and address coverage gaps effectively. These experts offer tailored advice that aligns with your specific insurance needs.

With their extensive knowledge of the insurance landscape, they look at your situation in a special way, ensuring that no potential risk slips through the cracks. By analyzing your existing policies alongside current market trends, they pinpoint areas where additional coverage may be necessary, ultimately safeguarding your assets.

Their knack for simplifying complex policy details gives you the power to make more informed decisions. When you work with an agent, you often receive personalized recommendations, leading to cost-effective solutions that resonate closely with your financial goals.

In essence, an insurance agent serves as your trusted advisor, guiding you toward optimal protection tailored perfectly to your lifestyle.

Preventing Coverage Gaps

Preventing coverage gaps is essential for securing complete financial security from your insurance policies.

By employing a range of proactive strategies, you can ensure that your coverage remains adequate and effective.

Tips for Maintaining Adequate Coverage

Maintaining adequate coverage is vital for shielding yourself from financial liability. Regular reviews of your insurance policies are key to ensuring that your coverage evolves in tandem with your needs.

By conducting these reviews annually, you gain a clearer perspective on how shifts in your personal circumstances like getting married, purchasing a home, or changing careers might impact your insurance requirements.

It’s also crucial to stay informed about industry trends and updates; changes in local laws or market conditions can significantly affect policy limits and premiums.

Consulting with a knowledgeable insurance agent can offer valuable insights into any gaps in your coverage and provide tailored recommendations.

Periodically reassessing your financial liability, particularly as your assets grow or shift, guarantees that your protection remains both comprehensive and aligned with your current reality.

Frequently Asked Questions

1. How do I identify gaps in my coverage?

You can identify gaps in your coverage by reviewing your insurance policies and comparing them to your potential risks and needs. Consulting with an insurance agent or using online tools can also help assess your coverage gaps.

2. What types of coverage should I check for gaps?

You should check for gaps in all types of insurance coverage that you have, such as auto, home, health, life, and disability insurance. Consider any additional policies you may need, such as umbrella insurance or professional liability insurance.

3. What are some common examples of coverage gaps?

Common examples of coverage gaps include not having enough liability coverage, lacking coverage for specific risks like flood or earthquake damage, and not having enough coverage for high-value items or assets.

4. What are the potential consequences of having coverage gaps?

The potential consequences of having coverage gaps include not being adequately protected in the event of a loss, incurring out-of-pocket costs for damages or liabilities, and facing legal and financial troubles if you are sued without appropriate coverage.

5. Should I review my coverage for gaps regularly?

Yes, it is important to review your coverage for gaps regularly, especially when your life circumstances change, such as getting married, having children, buying a new home or car, or starting a business. It s also a good idea to review your coverage annually to ensure it still meets your needs.

6. What should I do if I identify gaps in my coverage?

If you identify gaps in your coverage, take immediate action to address them. This might include purchasing additional policies, increasing your coverage limits, or switching to a different insurance provider. Consulting with an insurance professional is essential to ensure you have adequate coverage for your specific needs.

Don’t wait! Consult an agent today to ensure your coverage meets your needs. Act quickly if you find gaps to protect your future!