5 Essential Steps to Filing a Fire Damage Claim

Experiencing fire damage can be utterly devastating, leaving you feeling overwhelmed and uncertain about your next steps. Let s turn this setback into a comeback together!

Understanding how to navigate the claims process with your insurance company is essential for securing the support you need during this challenging time. This guide lays out five crucial steps for filing a fire damage claim, ensuring you know how to document the damage, protect your property, and collaborate effectively with your insurance adjuster.

It also addresses common questions, such as what’s covered, how long payouts typically take, and what to do if your claim is denied.

Contents

- Key Takeaways:

- 1. Contact Your Insurance Company Immediately

- 2. Document the Damage

- 3. Secure the Property

- 4. File a Claim and Provide Evidence

- 5. Work with Your Insurance Adjuster

- What Is Covered by a Fire Damage Insurance Claim?

- How Long Does It Take to Receive a Payout?

- Frequently Asked Questions

- What are the 5 essential steps to filing a fire damage claim?

- Do I need to document all the damage caused by the fire?

- How should I notify my insurance company about the fire damage?

- Can I stay in my home while waiting for repairs to be completed?

- Do I need to obtain multiple repair estimates for my fire damage claim?

- What should I do if my insurance company denies my fire damage claim?

Key Takeaways:

Contact your insurance company immediately after a fire to expedite the claims process and maximize coverage.

Document the damage with pictures and videos to provide evidence for your claim.

Secure the property to prevent further damage and ensure your safety before filing a claim.

1. Contact Your Insurance Company Immediately

In the aftermath of a fire, your first step should be to contact your insurance company without delay. This action is crucial for starting the claims process quickly, which will facilitate a smoother recovery journey while safeguarding your personal property and financial interests under your fire insurance policy. Additionally, if you’re dealing with earthquake damage, consider reviewing 5 tips for filing an earthquake damage claim to ensure you’re well-prepared.

Timely communication is crucial. It helps establish the timeline of events and the extent of the damage. When you reach out, be prepared to provide relevant information, such as your policy number and a preliminary assessment of the damages incurred.

This initial report sets the foundation for your claim and enables the insurance adjuster to begin evaluating the situation. The adjuster plays a vital role in determining the validity of your claim and the compensation you may receive. Any delay could jeopardize your coverage, making it imperative for you to act swiftly to secure the financial support you need.

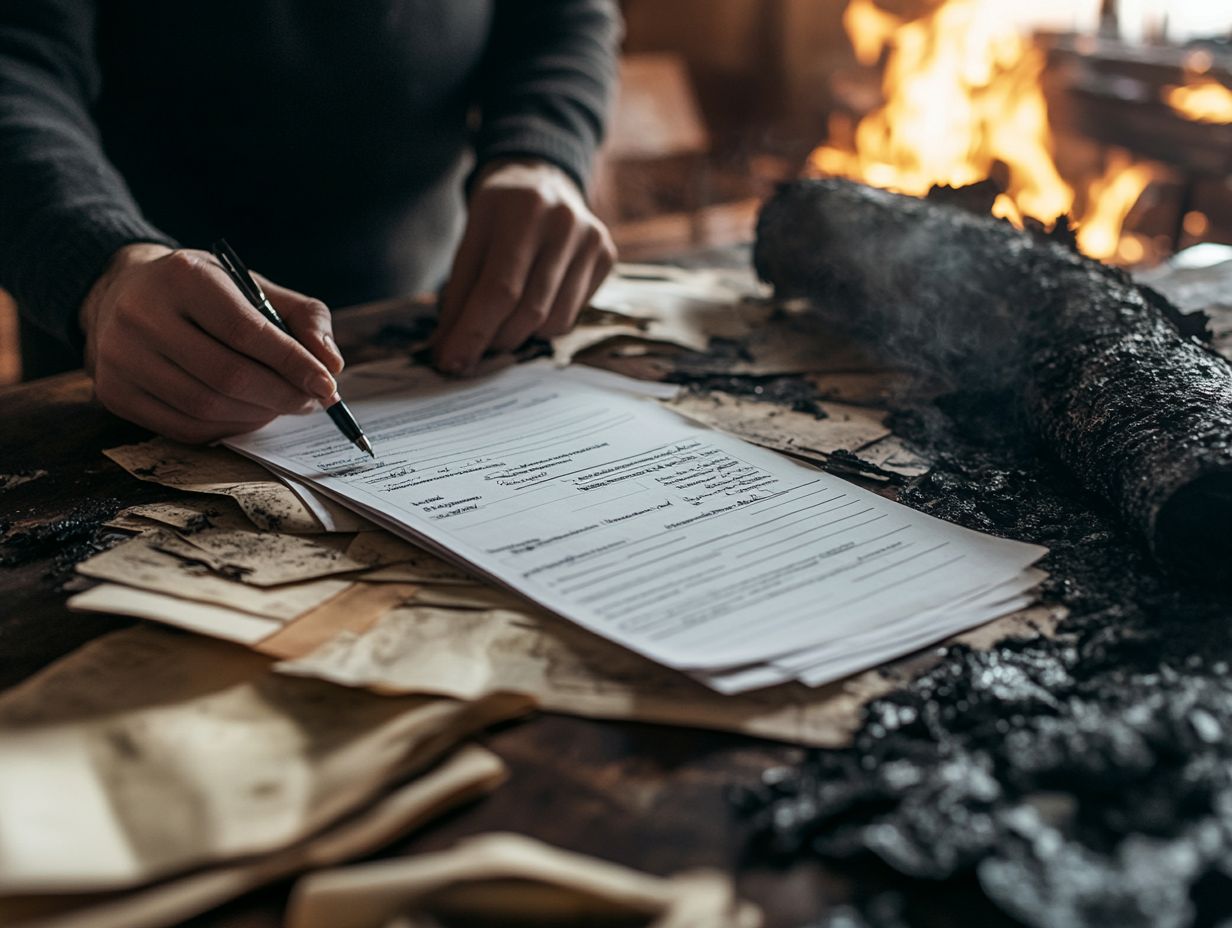

2. Document the Damage

Documenting the damage from a fire incident is essential for a successful insurance claim. Accurate documentation, including detailed photos and videos, provides the critical evidence you need to substantiate your fire damage claim. To further support your process, consider reviewing 5 ways to prepare for a home insurance claim to ensure that all structural and smoke damage is properly accounted for.

To kick off the documentation process, capture clear photos and videos of all affected areas. Focus on both wide-angle shots and close-ups that reveal the full extent of the damage.

Next, compile a comprehensive inventory list of personal property impacted by the fire, noting each item’s condition and estimated value. Additionally, be sure to understand how to file a claim for fire damage, as paying close attention to any structural damage can significantly influence your claim.

By assembling this thorough documentation, you not only strengthen your initial insurance claim but also position yourself advantageously should an appeal become necessary. This approach clearly demonstrates the severity of the situation and reinforces the validity of your claim.

3. Secure the Property

Securing your property after a fire is crucial to prevent further damage and avoid potential claims denial. Utilizing board-up services professional services that cover broken windows and doors to prevent further damage and making temporary repairs, like installing a roofing tarp, can protect your home from the elements and unauthorized access while repairs are in progress.

These initial actions are vital for safeguarding your belongings and streamlining the claims process. By taking proactive measures, you communicate clearly to your insurance provider that you are dedicated to minimizing damage. For additional guidance, consider these 5 things to know before filing a claim, which can significantly improve your chances of receiving the necessary support during recovery.

Actions such as covering broken windows or temporarily sealing doors help prevent additional water or weather damage, strengthening your case for prompt and adequate financial assistance from the insurer. In the aftermath of such devastating events, these temporary repairs can dramatically influence the speed and scope of your recovery process.

Don’t wait! Contact your insurance company today to get started on your recovery journey.

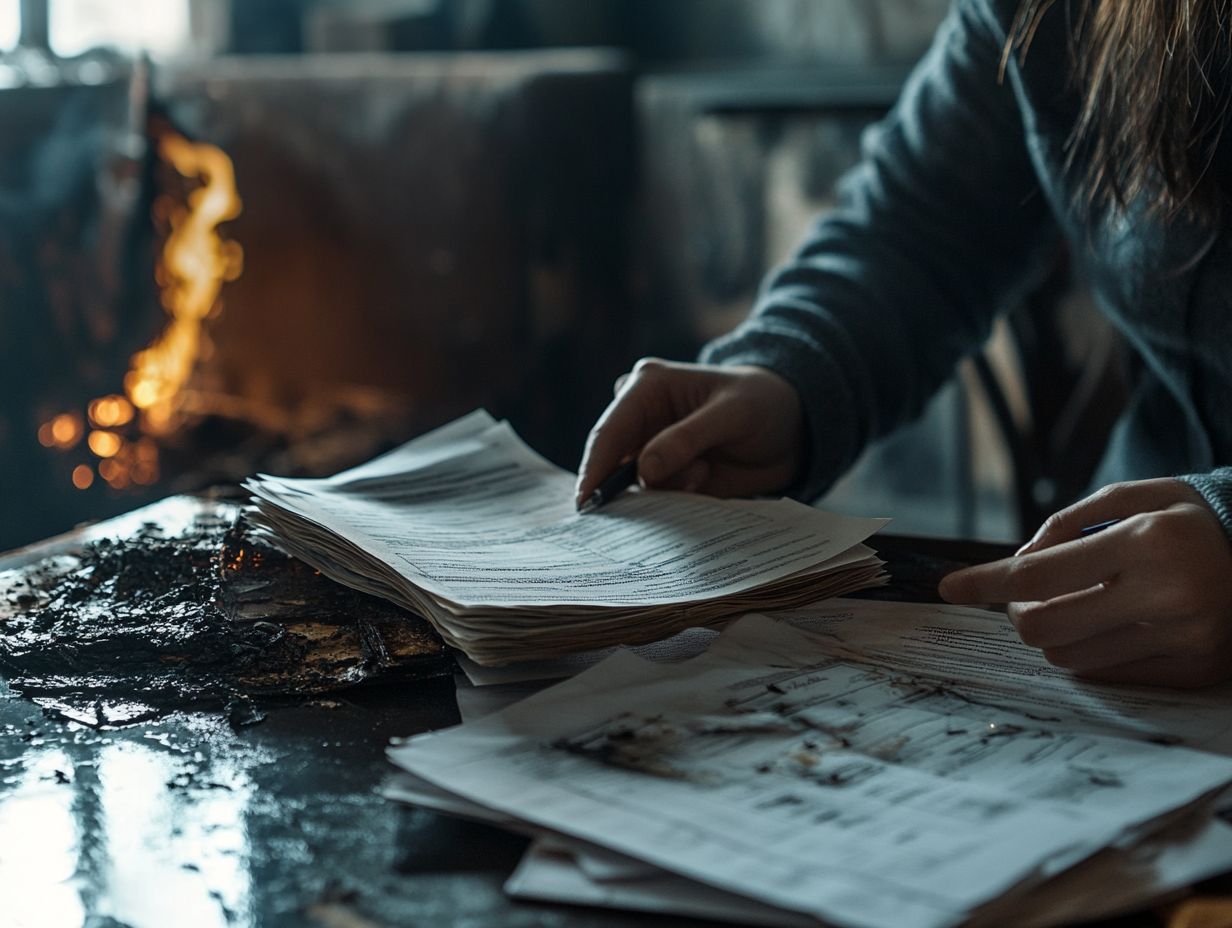

4. File a Claim and Provide Evidence

Filing a claim with your insurance provider is a vital step in recovering from fire damage. To ensure a smooth process, check out these essential tips for filing a home insurance claim. It’s essential that you provide detailed evidence, as this significantly influences the claim process and ultimately affects your settlement outcome.

To initiate this process effectively, start by gathering all relevant documents such as:

- your insurance policy

- photographs of the damage

- an inventory of lost items

- any associated receipts

Organizing this information in a neat folder makes it easier to talk with the insurance adjuster. Additionally, having a clear step-by-step guide to your home insurance claim can help you document the timeline of events related to the fire, demonstrating your proactive approach to addressing every aspect of the incident.

Maintaining open communication with the insurance adjuster can help clarify any uncertainties, making it easier for you to navigate the often-complex claims landscape. Being careful in your preparations strengthens your case and significantly reduces the risk of claim denials.

5. Work with Your Insurance Adjuster

Your insurance adjuster is your ally! Collaborating effectively with them can dramatically shape the outcome of your fire damage claim. They are there to navigate the claims process on your behalf, advocating for your recovery and ensuring that you make the most of your fire insurance coverage.

Establishing a constructive relationship with the adjuster is crucial; clear communication streamlines the process and builds trust. When you reach out, take the time to prepare your documentation meticulously.

Providing accurate and thorough information about the fire incident helps clarify your situation and allows the adjuster to grasp your needs and concerns more effectively. Keep those lines of communication open and don t hesitate to ask questions or seek clarification whenever necessary.

Act quickly to secure the compensation you need to recover, as their primary role is to assist you in obtaining the funds you deserve.

What Is Covered by a Fire Damage Insurance Claim?

Understanding what your fire damage insurance claim entails is essential for you as a policyholder. Typically, fire insurance covers structural damage, personal property loss, and additional living expenses, all depending on the specifics of Coverage A, Coverage B, and Coverage C outlined in your home insurance policy.

Coverage A focuses on the structural components of your home think walls, roofs, and foundations ensuring that repairs or rebuilding can proceed smoothly after a loss. Coverage B applies to detached structures like garages and sheds, protecting you against damages to these additional assets. Coverage C addresses your personal property, including everything from furniture to electronics.

It s crucial for you to grasp these coverage levels fully. Knowing the limits can significantly impact your recovery options, especially regarding any extra living expenses you might incur during repairs or rebuilding after a fire.

In summary, understanding your coverage can make a big difference in ensuring you re protected and prepared in the event of a loss.

How Long Does It Take to Receive a Payout?

The timeline for receiving a payout after filing a fire damage claim can vary significantly; it largely hinges on the complexity of the claims process, the efficiency of your insurance provider and adjuster, and the thoroughness of the documentation you submit.

Several factors play a crucial role in determining how quickly you can expect a resolution. The nature of the damage is paramount; extensive damages may require a longer assessment period as the adjuster evaluates the extent and costs involved.

Submitting a complete and well-documented claim can substantially expedite the review process. It s wise to maintain clear communication with your insurance company, promptly providing any requested information. Ensuring all necessary paperwork is in order from the outset can lead to a more streamlined experience.

You should also familiarize yourself with the standard processing times typical for your insurer, as this can offer valuable insights into what to anticipate.

What If My Claim Is Denied?

Experiencing a claim denial can be incredibly frustrating. It’s essential to understand your options. You can file a claim appeal or seek legal help from a fire insurance lawyer. They can help you understand the claims process better and potentially overturn that denial.

Knowing why your claim was denied helps you respond and stand up for your rights. Often, claims are denied due to:

- Insufficient documentation

- Parts of your policy that don t cover certain situations

- Missed deadlines

Upon receiving a denial letter, your first step should be to review the document carefully to grasp the reasons cited. Then, gather relevant evidence such as photographs, witness statements, and your policy details to strengthen your appeal.

If the denial feels unjust, consulting with a knowledgeable legal professional can offer insights and guidance. This way, you can pursue your rightful compensation with confidence.

Are There Any Additional Steps I Should Take After Filing a Claim?

After filing a fire damage claim, it’s wise to take extra steps to maximize your insurance benefits. For instance, if you experience water damage in the future, consider these 5 tips for filing a claim for water damage. Additionally, track expenses related to temporary living arrangements and restoration costs to support your recovery.

Keep detailed records of every expense. This not only protects your reimbursements but also strengthens your negotiation power with the insurance company.

This documentation serves as vital evidence that reinforces the legitimacy of your claims. It illustrates the disruption the fire caused in your life. With well-organized paperwork, you can reduce stress during the recovery process.

Make it easier to access important financial details when necessary and streamline your efforts to rebuild your life.

How Can I Prevent Fire Damage in the Future?

Preventing fire damage in the future is essential for your safety and can directly impact your home insurance premiums.

By implementing fire safety measures like installing smoke detectors and maintaining your electrical systems you can significantly lower the risk of incidents.

Conduct regular maintenance checks to spot potential hazards such as frayed wires or outdated appliances. Understanding common fire risks, like unattended cooking or overloaded circuits, is vital for fostering a safer living environment.

It s wise to leverage community resources, such as workshops offered by your local fire department. These often provide valuable insights into fire prevention techniques.

Enhancing your fire safety measures at home not only protects your property but may also make you eligible for discounts on your insurance premiums. This reflects the reduced risks that come with proactive safety practices.

What Should I Do If I Have Trouble Understanding My Policy or the Claims Process?

If you find yourself struggling with the intricacies of your insurance policy or the claims process, reach out to your insurance department for clarity. Seeking policyholder advocacy can help you untangle the complexities and ensure you re well-informed about your rights and options.

There s a treasure trove of resources to ease your navigation through these waters. A quick call to the customer service line can connect you with knowledgeable representatives ready to address your specific concerns.

If the situation feels overwhelming, consulting legal assistance can provide valuable insights tailored to your circumstances.

You can also use online tools for support and information, from interactive FAQs to chat support. Embrace these options to gain a clearer understanding, as being informed is vital for making sound decisions regarding your insurance.

Frequently Asked Questions

What are the 5 essential steps to filing a fire damage claim?

The five essential steps to filing a fire damage claim are:

- Write down what was damaged.

- Notify your insurance company.

- Seek temporary accommodations if needed.

- Obtain estimates for repairs.

- Negotiate for fair compensation.

Do I need to document all the damage caused by the fire?

Yes, it s crucial to document all the damage. Take photos, videos, and write notes about all affected areas and items.

This evidence will help you get fair compensation.

How should I notify my insurance company about the fire damage?

Contact your insurance company immediately after the fire. Quick action is essential to speed up the claims process for fire damage!

Use their claims hotline or online portal to provide the necessary information.

Can I stay in my home while waiting for repairs to be completed?

It s not recommended to stay in a home with significant fire damage. Seek temporary housing, like a hotel or a friend’s place, until repairs are finished.

Do I need to obtain multiple repair estimates for my fire damage claim?

Yes, get multiple repair estimates from reputable contractors. This ensures you receive fair compensation and aids in negotiating with your insurance company.

What should I do if my insurance company denies my fire damage claim?

If denied, you can appeal the decision. Gather more evidence and documentation to support your claim, and consider seeking legal advice.